U.S. Mining Equipment Market Gains from High Commodity Price Trends

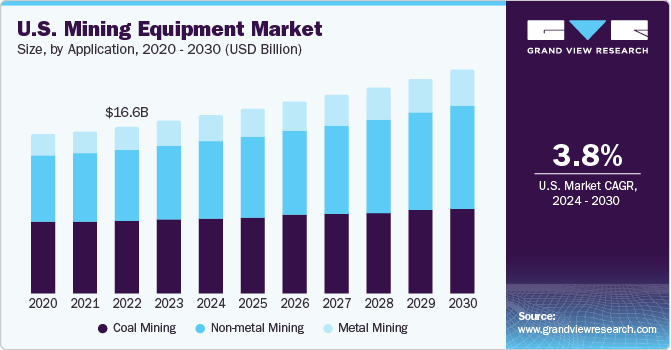

The U.S. mining equipment market was valued at USD 17.15 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 3.8% from 2024 to 2030. The surge in mining activity across the country, fueled by rising consumer demand, is a primary driver of equipment sales. There is growing demand for base metals and alloys in industries such as infrastructure, construction, and manufacturing. This, in turn, is increasing the need for equipment like drills, crushers, pulverizers, and mining trucks, which play a critical role in the efficient extraction of valuable minerals and metals. Additionally, a push toward environmentally friendly practices is prompting manufacturers to develop innovative equipment solutions, further contributing to market growth.

In 2023, the U.S. held a 12.14% share of global mining equipment market revenues. According to the National Mining Association, an average American uses about 3.4 tons of coal and more than 18,000 kilograms of newly mined products annually. Furthermore, coal and uranium together make up nearly 50% of the nation's electricity generation, emphasizing the sector’s critical role. Government support through regulatory frameworks and initiatives has strengthened demand for advanced mining equipment. Essential machines such as bucket wheel excavators, graders, shovels, haulers, loaders, and jumbo drills are widely used to facilitate excavation, overburden removal, and ore transport. Regulations by the Mine Safety and Health Administration (MSHA) ensure mining machinery complies with stringent safety standards, guiding innovation and quality in manufacturing.

The shift towards electric-powered equipment is emerging as a prominent trend in the market. Mining companies are adopting fully electric or hybrid diesel/electric machinery, especially for underground mining operations where managing exhaust fumes is essential for worker safety. These electric machines reduce the need for intensive ventilation and require less maintenance due to fewer moving parts compared to internal combustion engines. Although initial setup costs are high, proper mine design with electrification infrastructure can deliver long-term cost-efficiency and environmental benefits.

As intensive mining continues, ore grades across the U.S. are declining. This necessitates more energy-efficient comminution processes, thus increasing demand for high-performance equipment. Moreover, the mining industry is expected to gradually transition from surface to underground mining, supported by the growing utilization of polymetallic ores like lithium, copper, and cobalt, and the decreasing reliance on coal. This transition is likely to accelerate the adoption of advanced underground mining equipment incorporating technologies such as drones, sensors, GPS systems, and alternative power sources to enhance productivity and sustainability.

Order a free sample PDF of the U.S. Mining Equipment Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- By type, the one-way segment accounted for the largest share at 66.9% in 2023.

- By application, restaurants and hospitality spaces led the market in 2023.

- By offering, the hardware segment held the dominant share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 17.15 Billion

- 2030 Projected Market Size: USD 22.21 Billion

- CAGR (2024–2030): 3.8%

Key U.S. Mining Equipment Company Insights

Leading industry players include Caterpillar, Inc.; LIEBHERR; and Epiroc AB.

- Caterpillar, Inc., based in Irving, Texas, is a prominent global manufacturer of construction and mining equipment. Operating through three major segments—Construction Industries, Resource Industries, and Energy & Transportation—the company provides surface and underground mining solutions including articulated trucks, rotary drills, electric rope shovels, and hydraulic shovels under its Resource Industries division.

- Epiroc AB, with its U.S. operations headquartered in Colorado, serves surface, quarrying, and underground mining markets. The company focuses on automation and sustainability, offering zero-emission products. Notably, in December 2023, Epiroc inaugurated its National Competency Center in Elko, Nevada, to enhance its service offerings in the U.S. market.

- Emerging and notable players in the U.S. mining equipment space include SANY Group, Doosan Corporation, CNH Industrial America LLC, Deere & Company, and Komatsu. For instance, SANY Group, headquartered in Georgia, introduced five small excavators for the North American and European markets in November 2023, scheduled for release in 2024, to expand its international footprint.

Key U.S. Mining Equipment Companies:

- Caterpillar, Inc.

- CNH Industrial America LLC

- Deere & Company

- Doosan Corporation

- Hitachi Construction Machinery Co., Ltd.

- Hyundai Construction Equipment Co., Ltd.

- J C Bamford Excavators Ltd.

- Komatsu Ltd.

- KUBOTA Corporation

- LIEBHERR

- MANITOU Group

- SANY Group

- Terex Corporation

- AB Volvo

- Wacker Neuson SE

- XCMG Group

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

- Epiroc

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. mining equipment market is poised for steady growth over the coming years, driven by increasing mining activities, evolving technology, and strong regulatory support. As the sector transitions towards underground mining and sustainable practices, the demand for advanced and energy-efficient machinery will continue to rise. Innovations in electric and automated equipment will further enhance operational efficiency, safety, and environmental compliance, shaping the future landscape of the industry.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- ហ្គេម

- Gardening

- Health

- ផ្ទះ

- Literature

- Music

- Networking

- ផ្សេងៗ

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness