Pet Insurance Market Demand: Growth, Share, Value, Size, and Insights By 2036

Executive Summary Pet Insurance Market :

CAGR Value:

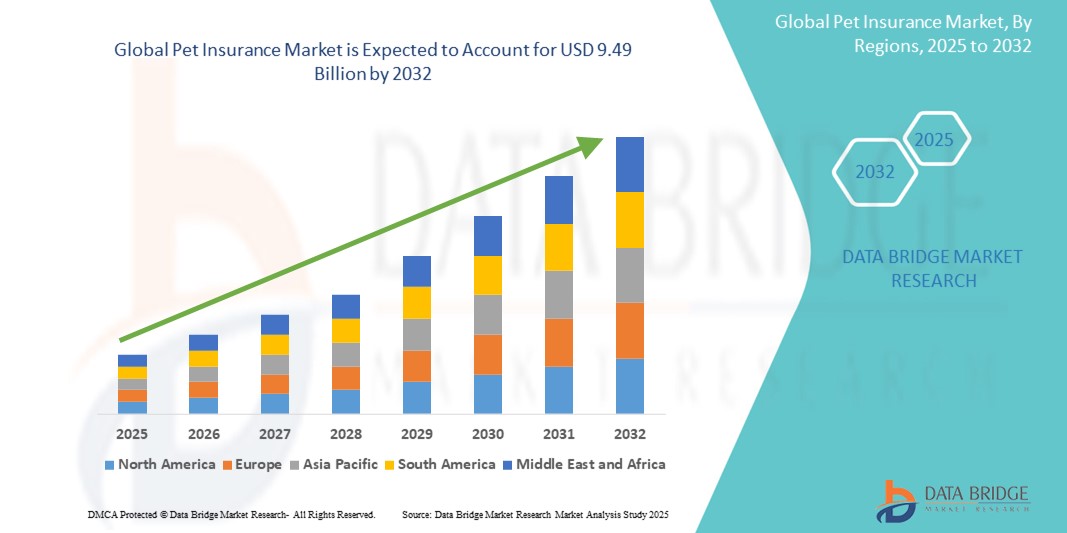

- The global pet insurance market size was valued at USD 47.32 Billion in 2024 and is expected to reach USD 9.49 Billion by 2032, at a CAGR of 94.00% during the forecast period.

A large-scale Pet Insurance Market business report endows with a profound overview of product specification, product type, production analysis, and technology by taking into consideration the major factors such as revenue, cost, and gross margin. The study derives market drivers and restraints by using SWOT analysis, along with their impact on the demand over the forecast period. This market report is the best source that gives CAGR values with variations during the forecast period of 2018 - 2025 for the market. The Pet Insurance Market report has been prepared based on the market type, size of the organization, availability on-premises and the end-users’ organization type.

In this Pet Insurance Market business report, estimations about the active state of the market, market size and market share, revenue generated from the product sale, and necessary changes required in the future products are mentioned in an appropriate way. Skilled analysts, statisticians, research experts, enthusiastic forecasters, and economists work together meticulously to structure such a great market research report for the businesses seeking a potential growth. This team is focused on understanding client’s businesses and its needs so that the finest market research report is sent to the client. This promptly transforming market place increases the importance of market research report and hence Pet Insurance Market report has been created in such a way that is anticipated.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Pet Insurance Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-pet-insurance-market

Pet Insurance Market Overview

**Segments**

- **By Policy Type**: The pet insurance market can be segmented into accident-only coverage, accident and illness coverage, and others.

- **By Animal Type**: The market is segmented based on the type of animal being insured, including dogs, cats, and other types of pets.

- **By Sales Channel**: This segment looks at how pet insurance policies are distributed and sold, whether through agencies, brokers, or direct marketing.

In terms of policy type, accident and illness coverage is expected to dominate the market as it provides comprehensive coverage for a range of health issues that pets may face. This type of coverage is particularly appealing to pet owners who want to ensure that their beloved companions are protected against both accidental injuries and chronic illnesses. The increasing awareness about the benefits of pet insurance and the rising number of pet owners are driving the growth of this segment.

When it comes to animal type, dogs are the most commonly insured pets, followed by cats. However, there is a growing trend towards insuring other types of animals such as birds, exotic pets, and even horses. This shift is fuelled by the increasing willingness of pet owners to go the extra mile to provide the best care for their pets, regardless of the species.

The sales channel segment is also crucial in the pet insurance market, as it determines how easily pet owners can access and purchase insurance policies for their pets. With the rise of digitalization, more pet insurance companies are offering online channels for policy purchase, making it convenient for customers to compare, select, and buy policies from the comfort of their homes.

**Market Players**

- **Petplan Limited**

- **Anicom Holdings, Inc.**

- **Healthy Paws Pet Insurance, LLC**

- **Nationwide Mutual Insurance Company**

- **Pets Best Insurance Services, LLC**

These market players are key contributors to the global pet insurance market, with a strong presence and extensive offerings catering to the diverse needs of pet owners. They focus on providing competitive insurance products, efficient claims processing, and exceptional customer service to retain existing customers and attract new ones in this increasingly competitive market.

In addition to the segmentation factors mentioned, another crucial aspect impacting the pet insurance market is the advancement in technology and data analytics. With the integration of digital solutions like mobile apps and online portals, pet insurance companies can offer a seamless experience to their customers, from policy purchase to claims processing. This digital transformation not only enhances customer engagement but also allows insurers to gather valuable data on pet health trends, customer preferences, and claims patterns. By leveraging this data effectively, pet insurance companies can tailor their offerings to better meet the evolving needs of pet owners and ultimately improve customer satisfaction and loyalty.

Moreover, the regulatory landscape plays a significant role in shaping the dynamics of the pet insurance market. As governments introduce new regulations or standards related to pet insurance, companies operating in this sector must adapt their products and practices to ensure compliance. Regulatory changes can impact pricing strategies, coverage options, and claims handling procedures, requiring insurers to stay agile and proactive in their approach. By staying abreast of regulatory developments and maintaining transparency in their operations, pet insurance companies can build trust with customers and demonstrate their commitment to ethical business practices.

Furthermore, the increasing focus on wellness and preventive care in the pet industry presents both challenges and opportunities for pet insurance providers. As pet owners become more proactive in maintaining their pets' health through routine check-ups, vaccinations, and specialized diets, insurers have the chance to expand their coverage options to include wellness benefits. By offering incentives for preventive care measures and promoting a holistic approach to pet health, insurance companies can position themselves as partners in promoting overall well-being for pets. This shift towards preventive care not only benefits the health outcomes of animals but also contributes to long-term cost savings for insurers by reducing the likelihood of expensive medical treatments for preventable conditions.

Another trend reshaping the pet insurance market is the increasing prevalence of customized policies and add-on services. As pet owners seek tailored solutions that address the specific needs of their pets, insurers are innovating by offering personalized coverage options such as breed-specific policies, alternative therapies coverage, and travel insurance for pets. By providing a range of customizable features and value-added services, insurance companies can differentiate themselves in a crowded market and attract discerning customers looking for comprehensive protection for their furry companions. This trend towards personalization and flexibility in insurance offerings reflects the evolving expectations of pet owners and the need for insurers to adapt to changing market demands.

In conclusion, the pet insurance market is experiencing rapid transformation driven by factors such as technological advancements, regulatory changes, preventive care focus, and personalized services. To capitalize on these trends and sustain growth in this competitive landscape, pet insurance companies must embrace innovation, customer-centricity, and agility in their operations. By aligning their offerings with evolving market dynamics and focusing on enhancing the overall pet ownership experience, insurers can position themselves for long-term success and meet the evolving needs of pet owners worldwide.The global pet insurance market is witnessing significant growth driven by various factors such as increased awareness among pet owners regarding the benefits of insurance, rising pet ownership rates, and the growing trend towards comprehensive coverage for pets. The dominance of accident and illness coverage in the market showcases the shift towards offering more holistic protection for pets, catering to the evolving needs of pet owners looking to safeguard their furry companions against a wide range of health issues. This emphasis on comprehensive coverage is expected to further drive market growth in the coming years as more pet owners recognize the value of insurance in providing financial security for unexpected veterinary expenses.

The segmentation based on animal type reveals a growing interest in insuring a diverse range of pets beyond traditional dogs and cats, including birds, exotic animals, and horses. This trend reflects the changing dynamics of pet ownership, where owners are increasingly considering insurance options for all their beloved animals, irrespective of their species. As pet insurance companies expand their offerings to accommodate different types of pets, they are likely to attract a broader customer base and capitalize on the expanding market opportunities presented by the rising demand for coverage across various animal categories.

The sales channel segment plays a crucial role in enabling convenient access to pet insurance policies for customers, with online channels gaining prominence in the digital era. The shift towards digitization allows pet insurance companies to streamline the policy purchase process, enhance customer experience, and leverage data analytics to better understand customer preferences and behavior. By investing in digital solutions and online platforms, insurers can strengthen their market position, improve customer engagement, and drive growth by tapping into the growing pool of tech-savvy pet owners seeking seamless insurance solutions for their pets.

In conclusion, the pet insurance market is undergoing a transformative phase characterized by advancements in policy offerings, expanding coverage options for different animal types, and the adoption of digital technologies to enhance customer experience and operational efficiency. As market players continue to innovate and adapt to changing market dynamics, they are well-positioned to capitalize on the evolving needs and preferences of pet owners worldwide. By leveraging segmentation strategies, embracing technological innovation, and staying attuned to regulatory developments, pet insurance companies can navigate the competitive landscape and sustain long-term growth in this dynamic and burgeoning market.

The Pet Insurance Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-pet-insurance-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

This comprehensive report provides:

- Improve strategic decision making

- Research, presentation and business plan support

- Show emerging Pet Insurance Marketopportunities to focus on

- Industry knowledge improvement

- It provides the latest information on important market developments.

- Develop an informed growth strategy.

- Build technical insight

- Description of trends to exploit

- Strengthen competitor analysis

- By providing a risk analysis, you can avoid pitfalls that other companies may create.

- Ultimately, you can maximize your company's profitability.

Browse More Reports:

Global Dental Implants and Prosthetics Market

China Surgical Visualization Products Market

Asia-Pacific Hyper-Converged Infrastructure Market

Global Beau's Lines Treatment Market

Global Inflammatory Disease Drug Delivery Market

Chile Menopause Drugs Market

Global Terahertz and Infrared Spectroscopy Market

Asia-Pacific Photogrammetry Software Market

Global Lice Treatment Market

North America Vanilla (B6C) Market

Global Bladder Cancer Therapeutics Market

Global Soybean Oil-Based Lubricant Market

Asia-Pacific Organo Mineral Fertilizers Market

Global Solid State Drive (SSD) Controller Market

Global Thiram Pesticides Market

Global DevOps Market

Global Human African Trypanosomiasis (Sleeping Sickness) Market

Global Marine Incinerators Market

Global Safety Switch Market

Global Managed Security Services Market

Global Perlite Market

Global Pet Sitting Market

North America Protein Hydrolysates for Animal Feed Application Market

Global miRNA Sequencing and Assay Market

Europe Gift Card Market

Asia-Pacific Urology Laser Market

Global Livestock Grow Lights Market

Global Blepharospasm Treatment Market

Global Cheese Processing Equipment Market

Global Ingestible Sensor Market

Global Signaling Devices Market

Global Corn Meal Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- ဂိမ်းများ

- Gardening

- Health

- အိမ်

- Literature

- Music

- Networking

- တခြား

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness